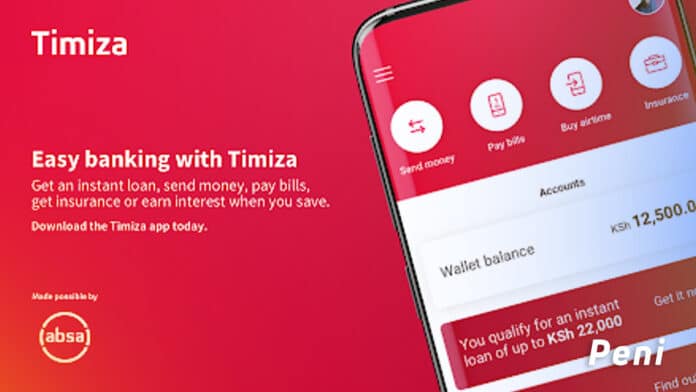

Timiza is an Absa Bank mobile banking app that allows you to perform your banking on your phone. Timiza provides several functions, including transmitting money, paying bills, buying airtime, and even paying for insurance. This blog post will concentrate on Timiza as a Loan App for getting a fast loan directly to your M-Pesa.

Timiza Lending App is a quick loan service that allows you to borrow up to KES 150,000 with a repayment period of 30 days. Read the rest of this post to learn more about Timiza Loans.

Timiza loan app download

To get started with Timiza App:

- Download from Google Play Store or IOS App store.

- You can also register by accessing Timiza USSD Code *848#

- After downloading it to your mobile phone, Register an account on Timiza App

- No visiting Absa bank or filling out unnecessary forms; you can start using Timiza services on your smartphone.

Timiza Requirements

You must satisfy the following prerequisites in order to utilise Timiza:

- You must be a registered Safaricom subscriber.

- You must be a registered Safaricom M-PESA client.

- Have an active Safaricom M-Pesa line.

- Have a Kenyan National Identification Document

So, in the following stages, we’ll show you how to secure a Timiza loan through the Timiza App.

How to Apply for a loan on Timiza App

Timiza loans are not disbursed immediately once you register on the app. It would be beneficial if you use it for some time to qualify. In addition, you must have used M-pesa for at least six months and have a good rating with CRB and Safaricom. Your phone should have been active for quite some time if you use other Safaricom services such as voice, data, and M-Pesa.

Here are steps to successfully apply for your first Timiza loan through Timiza App:

- Open Timiza App on your phone

- Select “My loans.”

- Select Request Loan

- Your loan limit will be displayed; you can enter a lower amount or this limit and Click on “Continue.”

- They will send the loan to your Timiza Account.

With the money in your account, you can withdraw to M-Pesa or pay bills and other services via the Timiza App.

How to pay Timiza’s loan

There are three ways you can use to pay the Timiza loan:

- Via Timiza M-Pesa Paybill Number

- or through Timiza shortcode *848#

- Through the Timiza app

Here is a breakdown of each method:

1. Loan payment using Timiza M-PESA Paybill Number

- Open the M-PESA application on your device.

- From the main menu, select the option for “Lipa na M-PESA.”

- Choose the “Paybill” option.

- In the Business Number field, enter “300067” (without the quotes), which is the Timiza Paybill number.

- In the Account Number field, enter your phone number.

- In the Amount field, enter the amount of the loan payment you wish to make.

- Enter your M-PESA PIN, then press “OK” to confirm.

- Review the transaction details to ensure they are correct, then press “OK” to complete the transaction.

2. Repaying Timiza Loan via shortcode

- Dial *848# on your phone.

- Enter your Timiza PIN when prompted.

- Select the “Loan” option by inputting the number 3.

- Choose the “Pay Loan” option.

- Confirm the current loan balance.

- Select the “Full Amount” option to clear your loan fully.

- Choose either “M-PESA” or “Timiza Account” as your payment method.

- Enter your Timiza PIN and press “Send.”

- The M-PESA kit will pop up on your screen if you pay from M-PESA.

- Enter your M-PESA PIN and press “OK” to complete the transaction.

I don’t recommend this method as it is too complicated. Either use the first or the following method to repay the Timiza loan.

How to Pay your loan using the Timiza app

- Open the Timiza App on your phone

- Enter your PIN

- Select “my loans”

- Select “Repay Loan”

- Choose between “Full” or “Partial” payment

- Choose to pay through “Timiza Account” or “M-Pesa”

- Follow the prompts provided and you will be successful in repaying your loan.

Timiza loan terms

- Timiza Loan attracts an interest rate of 1.27% charged once and a facilitation fee of 5% of the amount borrowed for 30 days.

- The maximum loan loans disbursed are up to KES 150,000, with no collateral required as the Customer’s security defaults.

- The Timiza Loans are disbursed to the Customer’s Timiza account (not directly to M-Pesa). The Customer accesses funds by withdrawing from Timiza to M-Pesa.

Also Read about other Loan apps, including the Tala loan app, Branch Loan App and Zenka loan App

I need loan

I need loan 500

It’s good

I need a loan of 1000

I need a loan of 5000 plz